The credit market mandated by the Renewable Fuel Standard ended 2023 in an unusual place, but that may be good news for RNG producers.

For over a decade, producers of cellulosic Renewable Identification Number credits, known as D3 RINs, have under-produced the amount of fuel expected for the RFS. Those producers include landfills and certain anaerobic digesters.

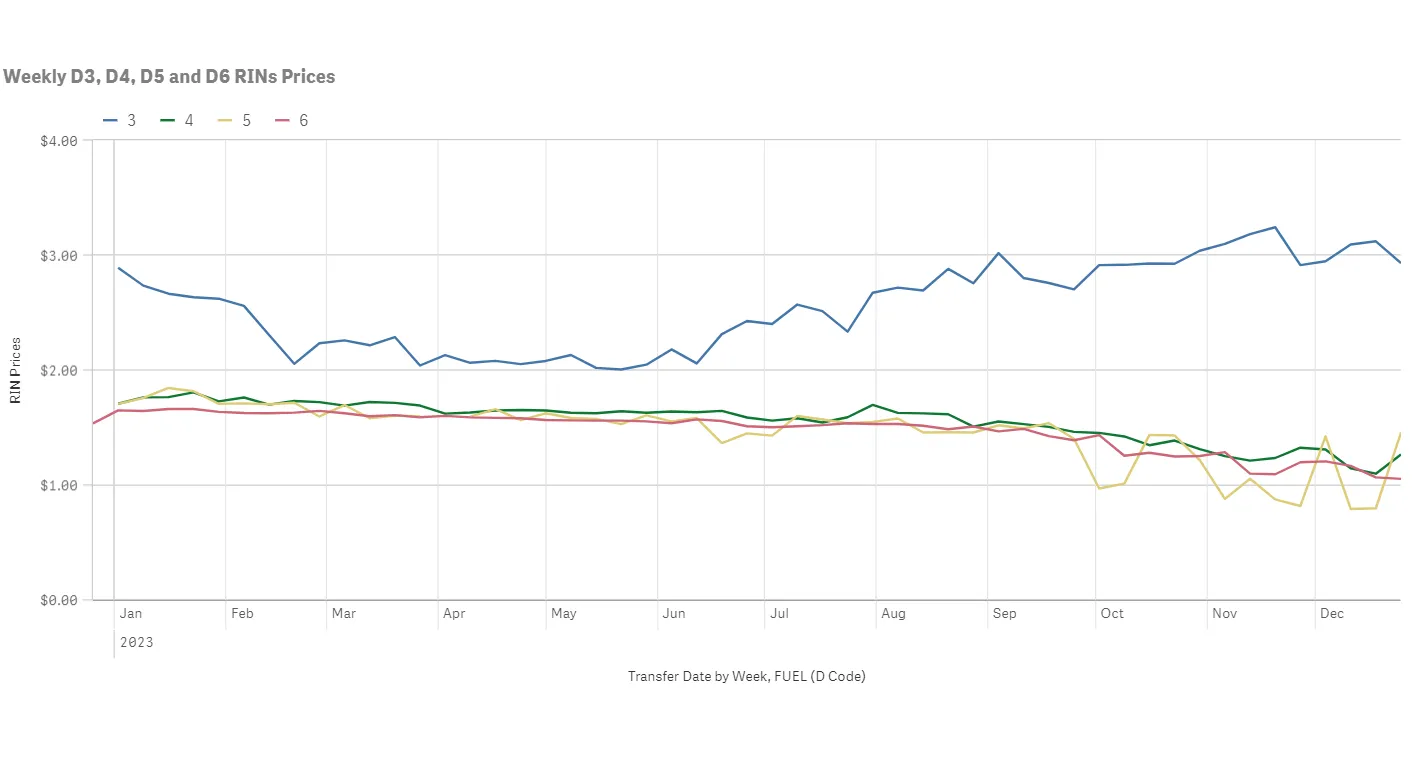

Underproduction meant the U.S. EPA had to annually issue a purchasable waiver credit for the petroleum fuel producers and importers that are required to buy D3 RINs. But the EPA’s authority to issue the Cellulosic Waiver Credit is mandated by Congress, and in 2023 that authority expired. So when the agency set new renewable volume obligations for those petroleum fuel companies with the RFS update in June, the companies saw that they would need to increase the number of D3 RINs they needed to buy. D3 RIN prices accordingly jumped last summer.

By the end of the year, prices for other biofuel credits fell as the market was oversupplied with renewable diesel. Prices for D3 RINs cooled somewhat, as producers generated 704 million D3 RINs against a target of 840 million, which is relatively close compared to previous years, per EPA data. But the lack of a waiver credit remains an upward pressure. Issues with supply also carried over into the new year, as some waste companies face delays in bringing RIN-generating facilities online.

What does that mean for the waste industry? A strong pricing environment for D3 RIN credits, at least in the short term, and room for growth as the industry begins another year with an optimistic expected output set by the EPA. Production of renewable natural gas will continue to ramp up in 2024, as these January announcements show.

Kinder Morgan’s 2024 projections

Kinder Morgan anticipates an annual production capacity of 6.4 billion cubic feet of RNG by the end of 2024, according to an investor presentation shared by the company in January. The energy infrastructure company brought three RNG facilities online in 2023 and expects another by the second half of this year. It’s also eyeing additional opportunities to convert other landfill-gas-to-electricity assets it owns to RNG facilities.

The company currently has $84 million committed to its energy transition project backlog, 92% of which goes toward RNG investments. That money will be spent over multiple years, and remains a fraction of what Kinder Morgan is spending on its fossil fuel infrastructure.

Once all RNG projects are online, Kinder Morgan expects the projects to be worth six times the earnings they generate before interest, taxes, depreciation and amortization. The company said it was primarily contracted in the transportation and RIN credit market for its RNG today, but sees opportunity in the voluntary fuel offtake agreement market.

WM partners with NW Natural at Washington landfill

A natural gas utility in the Pacific Northwest is partnering with WM for its first RNG project. NW Natural will build the facility at WM’s Greater Wenatchee Regional Landfill and purchase the gas for 20 years, NCW Life Channel reported. The project is expected to produce 300,000 mmBtus of RNG annually and be sold into the region’s natural gas grid when it’s completed in 2025.

The Greater Wenatchee landfill was one of four identified by the state of Washington for its strong landfill-gas-to-RNG potential in a 2018 report. In 2021, the landfill was among Washington’s top 10 industrial sources of methane pollution, according to EPA data analyzed by climate solutions group Industrious Labs. Washington’s Department of Ecology is in the process of finalizing a landfill emissions rule that would tighten regulations for many of the state’s landfills, including through stronger methane destruction or refinement efficiency requirements.

First Oklahoman municipal landfill signs RNG agreement

The town of Enid, Oklahoma, joined officials from Sparq Renewables and NextEra Energy Resources to break ground on an RNG facility at the Enid City landfill in January. The partners created Scissortail Renewables as a joint venture to manage the project.

The facility will be the first to upgrade landfill gas to RNG at a municipally owned landfill in the state. It will inject RNG into the existing Oklahoma grid once completed.

Waga Energy’s North American opportunities grow

French RNG company Waga Energy is partnering with Best Way Disposal, based in Kalamazoo, Michigan, to build a landfill-gas-to-RNG facility at a site in Greensburg, Indiana. The facility is expected to inject more than 200,000 mmBtus of RNG into the natural gas grid once it comes online by the end of 2025. As part of the agreement, Waga will operate the facility for 20 years.

Waga’s partnership with Best Way is its seventh gas rights agreement in the U.S. It currently operates 19 facilities, and has 16 on the way, including in Quebec.

There, a provincial energy regulator recently allowed natural gas provider Énergir to require all new customers to contract for 100% RNG as soon as April. The utility company is mandated to reach 5% RNG in its pipelines by 2025, but that target has been difficult to reach since it reportedly found few customers willing to include RNG in their contracts as recently as 2022. Énergir and Waga have partnered on RNG production and pipeline injection, most recently at a closed GFL Environmental landfill in Chicoutimi, Quebec.