U.S. policy on electric vehicles and the critical minerals crucial to their production is rapidly changing. But lithium-ion battery recyclers remain hopeful that their businesses can help meet the Trump administration’s domestic manufacturing objectives.

President Donald Trump has moved to reverse many of former President Joe Biden’s signature clean energy incentives — including tax breaks for EVs and grants for certain battery recycling projects — sparking concerns about decreased demand for recycled lithium. Batteries are a major market for lithium, accounting for 87% of global lithium demand, according to the U.S. Geological Survey.

But the EV industry is maturing, and the impacts of the Trump administration’s policies remain to be seen, according to analysts. Despite a dip in U.S. EV sales during Q2, the category saw a 1.5% increase in the first half of 2025 compared with the same period in 2024.

The Trump administration has embraced boosting production of lithium and other critical minerals for other uses, such as weapons manufacturing. These developments give some in the battery recycling industry hope that the sector will weather the administration’s shift in energy policies, regardless of what happens with federal grants.

“There will definitely be continued growth,” says Ryan Melsert, CEO of the American Battery Technology Co. “I think the rate of change will be different. But remember that subsidies are always meant to be temporary.”

The administration’s tariff policy, which currently includes a 30% import rate on goods from China and 15% tariff on EU imports, adds another twist.

“Tariffs may increase short-term costs for domestic battery manufacturers, specifically those relying on imported components,” said Danielle Spalding, vice president of communications and public affairs for battery recycler Cirba Solutions, adding that they may also encourage more domestic sourcing. “By reducing reliance on foreign materials, these measures aim to strengthen long-term resilience and competitiveness in the U.S. battery sector.”

Shifting priorities

In January, Trump signed an executive order that calls for making the U.S. “the leading producer and processor of non-fuel minerals,” including rare earth minerals. And in March, he invoked emergency powers to accelerate domestic production of critical minerals as part of a broader effort to dampen China’s dominance of the sector. That executive order directs agencies to “facilitate domestic mineral production to the maximum possible extent,” including by streamlining permitting and prioritizing funding for the production of critical minerals.

While the orders place a heavy emphasis on increasing domestic mining, battery recyclers see an opportunity to position their services as an attractive alternative or even complement. Extracting critical minerals such as lithium, cobalt, nickel and manganese from used EV batteries is faster and cheaper than mining and can accelerate the U.S.’s uncoupling from foreign supply chains, said Spalding.

“I think that battery recycling is a phenomenal tool to provide support for enhancing national security and the critical mineral supply, and it’s also a job creator,” Spalding said. “It is something that’s available today and it’s a growing sector that supports the administration’s goals as well as those of organizations that need to increase their access to raw materials.”

But some observers say the Trump administration’s scuttling of EV incentives and other renewable energy policies is likely to take a toll, and could hurt an emerging industry.

Jessica Dunn, a scientist who focuses on clean transportation at the Union of Concerned Scientists, said the rolled-back tax credits, grants and vehicle standards are “a huge blow to the U.S. becoming competitive in the emerging market.” The changes to the “new clean vehicle” tax credit, 30D, is particularly concerning, she said. That credit, which was partly tied to domestic production, boosted sales for EVs as well as batteries and EVs made in the U.S.

Dunn said lithium-ion battery recyclers may need to look to other sectors, such as defense, for their supply.

“It is a nascent industry that is relying on an influx of EV battery retirements after 2030,” she said. “To ensure that this U.S. industry continues to operate and a lower-impact mineral supply is created, it is essential that we enact requirements for producers to recycle these batteries and recover their minerals at the end of their life.”

Industry observers see a cautionary tale in the fate of Li-Cycle, a nine-year-old battery recycling company that filed for bankruptcy in May. The startup created a technology that allowed for the shredding of lithium-ion battery packs while immersed in liquid to reduce fire risk and increase efficiency.

It had built five facilities to pulverize vehicle battery packs into black mass and was beginning to build a refinery near Rochester, New York, that would extract materials from the powder to reuse. But construction stopped in 2023 after the company ran out of money to complete the building. DOE awarded the company a $475 million loan for the facility in November 2024, but by last spring Li-Cycle was warning of a lack of capital to be able to access the loan. It was recently sold to Glencore via a bankruptcy auction.

In another sign of industry uncertainty, Ascend Elements delayed construction of a recycling plant in Kentucky after a buyer of the recycled materials pulled out of the deal. Ascend also lost DOE funding, in its case a $164 million grant, due to “changing market conditions.” A separate $316 million DOE grant remains intact.

Some companies, however, continue to expand. Redwood Materials, for example, is constructing a major facility near Reno, Nevada, close to a Tesla factory and launched an energy storage business earlier this year that repurposes EV batteries. Redwood received DOE funding in 2023, but rejected the loan last year after raising $2 billion in private financing and earning $200 million in revenue from recycled materials.

Cirba is also moving ahead with expansion plans. The company’s $200 million DOE grant to build a lithium-ion battery recycling plant in Columbia, South Carolina, under 2021’s Infrastructure Investment and Jobs Act remains intact, Spalding said.

The South Carolina plant will be able to process 60,000 tons of used batteries from retired EVs, energy storage systems and other sources annually, producing enough battery-grade salts for about 500,000 EV batteries each year.

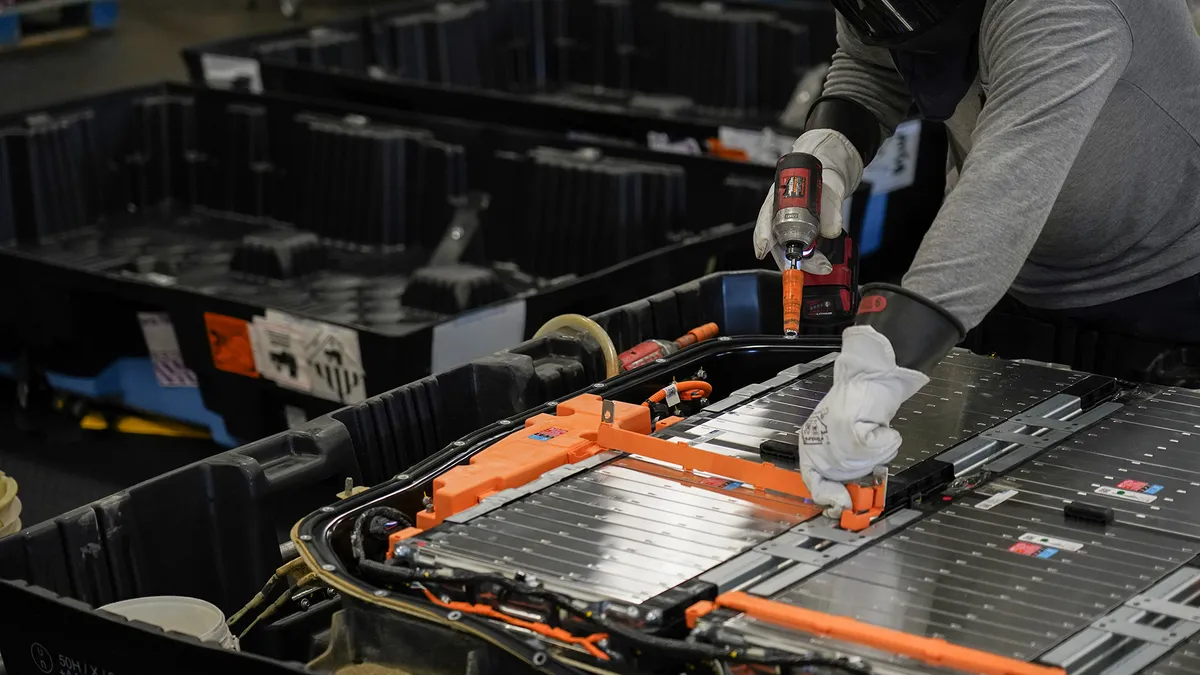

Cirba, which has a well-established black mass operation — which it says was the first to process the material at a commercial scale in the U.S., back in 2015 — is also expanding its facility in Lancaster, Ohio. That plant, funded by a pair of DOE grants totaling about $82 million, is on track to increase production 600% since 2022. Cirba’s recycling process involves disassembling battery packs, shredding the components, separating the material in a sink-float tank, then extracting the critical metals using a water-based process.

A decade ago, “you’d have to pay to recycle lithium ion,” said Spalding, who also chairs the Recycled Material Association’s battery policy working group. “And now that we’re getting economies of scale, we’re seeing this ability to now hopefully refine it more.”

Looking ahead

Despite all of the change this year, Dunn from the Union of Concerned Scientists is cautiously optimistic about the industry’s future. According to a 2023 McKinsey & Company report, demand for lithium-ion batteries was poised to increase 27% a year between 2022 and 2030.

And even though other battery technologies continue to evolve, lithium-ion batteries are likely to remain dominant for the foreseeable future, Spalding said. And recyclers are well-positioned to help meet that demand, Melsert added.

“The elements within batteries can be used indefinitely,” he said, because they don’t degrade during the recycling process. ABTC’s technology involves breaking down the batteries into progressively smaller parts and then separating out the metals in water.

Melsert added that his company’s strategy of locating battery recycling facilities near EV plants helps reduce costs and logistical challenges for both parties.

“It makes sense that, at the end of the life of the batteries, you recover the elements and circulate them back locally. When you do, you have much shorter transportation distances, you have lower costs, and lower emissions,” he said, adding that the steady supply of battery materials can also help manufacturers boost production. “They have a lot of certainty about where their next feedstock is going to come from.”

Melsert said a $144 million DOE grant awarded in December to support construction of a second lithium-ion battery recycling plant remains active. ABTC’s strategy also includes lithium mines, which Melsert said positions the company well to weather policy changes.

“We do need recycling and we do need new minerals introduced into that loop,” he said. “That's why we chose to have both of the businesses – because the industry really needs both.”

In June, ABTC’s Tonopah Flats Lithium Project, a surface lithium mine to be built in Nevada, was fast-tracked under Trump’s executive order to increase domestic mineral production. The site is currently scheduled to begin pilot operations by 2027 and commercial production in 2028.

As the post-Biden business and regulatory landscape takes shape, experts see a mixed but promising future for the sector.

“I believe the U.S. still has the potential to be a top lithium producer given the ongoing growth in global demand,” said Dunn. “However, without these policies, we will see less lithium eventually ending up in the batteries of U.S. vehicles, solely because of a slower transition to electric vehicles, therefore impacting the lithium-ion battery recycling facilities and the supply of recovered minerals in the U.S.”