Dive Brief:

- Private equity firm EQT is acquiring a majority stake in waste and recycling software company AMCS, the deal partners announced Wednesday.

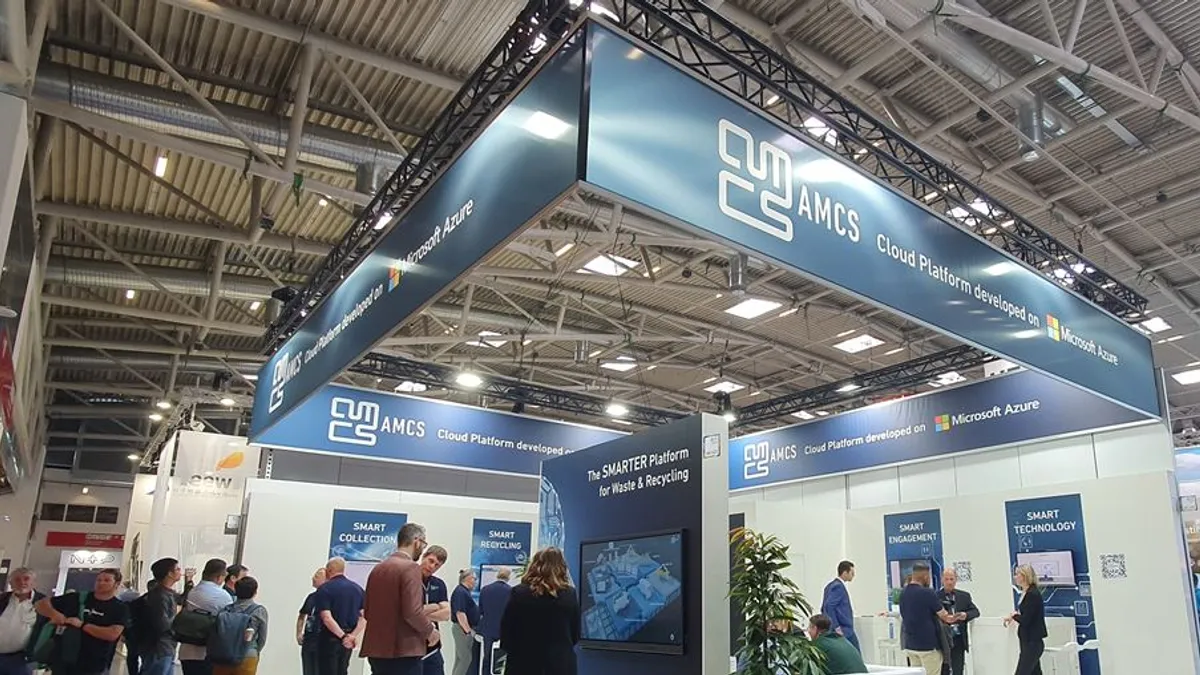

- Ireland-based AMCS provides a cloud and software platform for clients across 80 countries, managing more than 700,000 vehicles globally. Its current investors, which include Insight Partners, Clearlake Capital, Highland Europe and the Ireland Strategic Investment Fund, will continue to have minority stakes in the company, according to the release announcing the deal.

- The two sides did not disclose a deal price. They expect the transaction to close before the first quarter of next year.

Dive Insight:

The deal adds AMCS to a list of waste industry companies in the Swedish investor's portfolio, including Reworld and Heritage Environmental Services. While the latter companies received investment from EQT’s infrastructure division, AMCS received investment from its private equity arm.

Founded in 2003, AMCS provides a cloud-based software platform that integrates various functions for fleets, including route management, AI-enabled camera technology, data reporting and others. AMCS has benefitted as the collections industry has consolidated, bringing more fleets into its clients’ portfolios.

The company has executed more than a dozen acquisitions, allowing it to serve apprimately 3,800 customers worldwide today. It has more than 1,300 employees across Europe, North America, Asia and Australia, according to the release.

"We have followed the progress of AMCS closely for many years and have been hugely impressed by what it has achieved, establishing itself as a clear market leader and delivering continuous innovation on behalf of its customers," Robert Maclean, a partner in the EQT Private Equity advisory team, said in a statement. "We strongly believe that AMCS has a fantastic opportunity to further support the circular economy and drive a greater share of recycling within the waste industry."

The deal comes amid a shifting financial landscape for software companies that serve waste and recycling customers. Rubicon, another digital waste broker, recently spun off its fleet technology division amid financial troubles. Another software-focused waste broker, Reconomy, also announced it had acquired Lincoln Waste Solutions, a Connecticut-based firm, on Monday. And last year, waste technology provider Routeware Global acquired Recyclist, a compliance and sustainability software provider for the industry.

EQT is investing in AMCS via its main private equity fund, EQT X, and its "impact-driven, longer-hold fund," EQT Future. The investor plans to leverage its experience in the software space to accelerate AMCS' growth over a “long-term investment horizon,” according to the release. EQT executives also highlighted AMCS' role as a sustainability leader for haulers and other partners looking to improve their recycling capabilities.

AMCS contracted with financial advisory firm William Blair for the transaction. The firm highlighted AMCS’ role in the cleantech space as a selling point in the deal.

“The AMCS transaction underscores two trends we see in the market: importantly, the positive impact which software companies can make with their solutions to drive measurable sustainability improvement for resource intensive-industries; as well as the private equity industry’s expanding appetite to back both market leading software and sustainability platforms globally, and to do so with multiple capital strategies,” Raphael Grunschlag, managing director in William Blair’s technology investment banking group, said in an emailed statement.

Co-founder and CEO Jimmy Martin is expected to continue leading the company, per the release. He said EQT’s backing is “instrumental” to AMCS’ mission to champion the circular economy.