Waste haulers are confronting a busy season of emissions regulations as the EPA proposes new guidelines and California finalizes its own zero-emission standards.

On Wednesday, the U.S. EPA proposed a new rule that would tighten emissions requirements for medium- and heavy-duty vehicles.

Meanwhile, the California Air Resources Board is nearing a final vote on its Advanced Clean Fleets rule, a leading regulation that would mandate that owners of truck fleets transition to zero-emission vehicles over the next decade-plus.

The moves come as regulators look to rein in emissions from heavy-duty vehicles like waste and recycling trucks, a category of vehicles that has historically faced a slower decarbonization timeline than consumer vehicles but now accounts for an outsized portion of transportation emissions. Medium- and heavy-duty vehicles accounted for nearly a quarter of all transportation-related emissions in the U.S., according to the EPA's 2021 data, despite accounting for less than 10% of on-road vehicles.

The waste industry has made voluntary commitments that, if followed, would address some of those emissions. Recology, a hauler with a significant presence in California and the West Coast, announced Monday it had reduced its emissions by 44% over three years, in part by shifting to cleaner fuels and incorporating its first electric vehicles.

But environmental advocates and the waste industry have locked horns over an exemption that would allow haulers to delay their purchase of zero-emission vehicles.

The National Waste & Recycling Association did not respond to requests for comment about California’s regulations pertaining to the trucking industry. But in public comments, industry majors like WM have urged caution in implementing rules that set an ambitious scale-up in zero-emission vehicles.

“Although WM supports the state's long-term goal of electrifying the transportation sector, we believe that the final rule should be revised to consider and give credit to the large investments already made,” said Alex Oseguera, WM's director of government affairs for California and Hawaii, in a letter submitted Oct. 14.

Meanwhile, groups like the Natural Resources Defense Council and Sierra Club have applauded the rules and argue that California can work with the manufacturing industry, utilities and other affected groups to achieve a rapid transition.

EPA sets new standards for vehicle emissions

The EPA said major incentives from recent legislation are expected to spur more rapid adoption of zero-emission vehicles, which include battery electric and hydrogen fuel cell constructions.

Federal funding allocated through the Bipartisan Infrastructure Law and the Inflation Reduction Act provide up to $7.5 billion for electric charging and hydrogen refueling infrastructure for all vehicle classes. It also includes a $40,000 per-vehicle tax credit for “qualified commercial clean vehicles” over 14,000 pounds and an additional tax credit for battery cell and module production, according to the EPA.

Additionally, innovation in and adoption of zero-emission vehicles has occurred more quickly than the EPA anticipated when it finalized its previous, Phase 2, emission rules in 2016, the agency noted. That shifting landscape also applies to the waste industry, where battery electric vehicles could represent 63% of refuse truck sales by 2030, according to a white paper released in January.

The rulemaking process began after an August 2021 executive order from President Biden instructing the EPA to look into more stringent standards regarding fuel economy, pollutants and fuel efficiency standards. In December 2022, the EPA released a related rule that could reduce nitrogen oxide emissions from heavy-duty vehicles 48% by 2045.

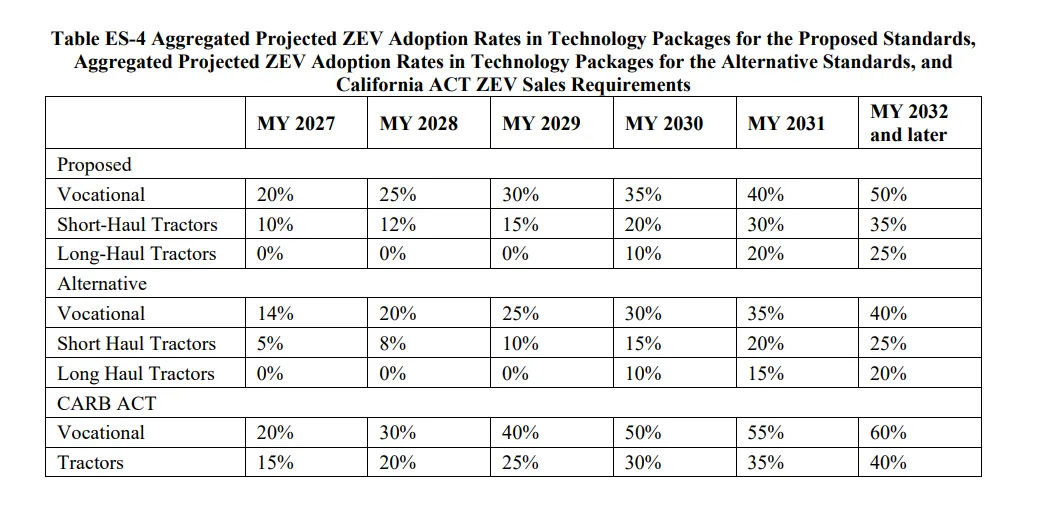

The rule released Wednesday would apply to model years 2027 through 2032, with the EPA seeking comment on additional standards in subsequent years. For vocational trucks, the EPA's proposed pathway would require 20% adoption of zero-emission vehicles in model year 2027 and 50% adoption by model year 2032. That pathway would start at the same place as California’s existing Advanced Clean Trucks rule, but the California rule ramps up more quickly, requiring 60% adoption by model year 2032.

The EPA’s proposed ramp-up is slower for short-haul tractors, going from 10% in 2027 to 35% by 2032. Long-haul tractors wouldn't be phased in until model year 2030, when the rule would require 10% adoption, and then it would ratchet up to 25% by 2032.

Trucking groups decried the more stringent rule, arguing that while it applies to manufacturers, customers like waste haulers would feel the squeeze.

But environmental groups like Calstart said the rules are a first step in bringing down the sector’s emissions. What’s more, Patricio Portillo, a senior advocate with the NRDC, said the rules were a “disappointment” because they didn’t align with what states like California are already doing to ramp up adoption.

“We need strong national standards to ensure truck makers deliver the vehicles that will protect communities and the planet,” Portillo said in a statement.

The EPA is hosting virtual hearings on the rules on May 2 and 3, plus a possible third hearing on May 4. The comment period closes 50 days after the rule’s publication.

California moves from EV supply to demand

California has long been on the bleeding edge of air and vehicle regulations, and its efforts have continued after receiving a green light from the EPA for its Advanced Clean Trucks rule on March 31.

The rule set vehicle manufacturers on a timeline to scale up the proportion of zero-emission vehicles sold, with the goal of ensuring all new truck sales are zero-emission by 2035. With the EPA’s waiver, its path is cleared for implementation.

The move was opposed by the trucking industry, which argued that supply-chain issues and vehicle charging infrastructure made a mandated scale-up too risky, preferring to let the market move at its own pace within preexisting regulations.

Environmental groups disagree with that assessment of the infrastructure landscape, and California regulators — joined by those in six other states — are pressing forward regardless.

To supplement the supply-side Advanced Clean Trucks rule, CARB circulated a draft of its demand-side Advanced Clean Fleets rule in October. The public comment period closed Friday.

The rule would require most medium- and heavy-duty vehicle fleet owners to purchase 100% zero-emission vehicles by model year 2036. Among groups in that target are last-mile delivery vehicles, off-road yard trucks and government fleets.

In an exception endorsed by the waste industry but criticized by environmental advocates, waste and wastewater fleets that participate in organic waste collection would follow a delayed timeline, purchasing 100% zero-emission vehicles by 2042. The exemption would apply to about 10,000 CNG trucks, while about 6,000 diesel-fueled trucks would not be exempt, according to the Sacramento Bee.

CARB staff held a public meeting to discuss the new rule in October and met with a waste and wastewater fleet working group in December, according to public documents. Following feedback, the board decided to expand the exemption because of the substantial investments the waste industry has made in CNG trucks.

Two of the waste industry's biggest players, WM and Republic Services, also submitted comments on the rule, pushing for further exemptions for their fleets. In comments, they urged for leniency on restrictions for vehicles only used seasonally and in granting extensions for areas where grid infrastructure is insufficient.

WM has invested $2.5 billion in natural gas vehicles and $550 million in fueling infrastructure, and it operates more than 2,000 natural gas trucks in California today, according to the company’s comments.

"Infrastructure readiness is a critical concern regarding powering large electrified solid waste fleets," wrote Oseguera, the regional director of government affairs. "The electrical supply needed for a 50-100 vehicle site is significant and the infrastructure is not in place in most cities and counties in California. Additionally, lag times for increased delivery of energy from suppliers seems to be in the range of two to five years."

In its own submitted comments, Sierra Club California noted that California has already set aside $1.7 billion for medium- and heavy-duty vehicle infrastructure over four years, and additional incentives from the Inflation Reduction Act could assist in the transition.

With the public comment period closed, the board expects to vote on the rule at its April 27-28 meeting, where industry experts think it's likely to pass. A CARB spokesperson confirmed the board expects to apply for an additional waiver from the EPA to implement the rule, like it did for the Advanced Clean Trucks rule.

NRDC’s Portillo acknowledged that California is charting an ambitious course to ramp up its grid and charging capacity. But rather than grant exemptions for the waste industry, he’d rather see CARB work with other state and federal agencies to identify funding opportunities for the infrastructure needed for a transition.

“The overall trend toward zero-emission vehicles is global, it’s occurring, and the folks that tried to resist it or wait to take action … are going to be the real losers,” Portillo said. “It's definitely a period of change, but also a period of opportunity.”

Achieving that change will be an uphill climb. The League of California Cities, which has advocated for more local funding to ease implementation for other state waste regulations, including SB 1383, said jurisdictions would need assistance and flexibility from CARB to meet publicly-run refuse fleet requirements under the Advanced Clean Fleets rule.

“Cities across the state are pursuing environmentally sound and robust strategies to decarbonize their communities,” Damon Conklin, League lobbyist, wrote in submitted comments. “Cal Cities seeks to ensure that policy does not overburden our member’s communities and add to the mounting regulatory costs of California’s rigorous goals.”