UPDATE: May 29, 2025: Brightmark will retain control of the facility formerly run by its subsidiaries and keep it in operation after a judge accepted the company’s bid, Resource Recycling first reported. Brightmark’s nearly $14.3 million bid was accepted instead of creditor UMB Bank’s higher bid because it would avoid the costs of canceled contracts or a site shutdown and cleanup, Judge Laurie Selber Silverstein ruled.

“We believe in our plastics business and providing a viable, circular recycling solution for post-use plastic while working to solve waste challenges at scale,” Bob Powell, founder and CEO of Brightmark, said in a statement. “The retention of the Ashley facility is an important step in accomplishing our mission.”

Dive Brief:

- March 18: Three subsidiaries of Brightmark filed for Chapter 11 bankruptcy on Monday in a Delaware court. As part of the plan to address $178.3 million in debt, the subsidiaries plan to sell assets related to the company’s pyrolysis facility in Ashley, Indiana.

- The bankruptcy is specific to the Ashley plastics “circularity center” and does not affect other parts of Brightmark’s business, the company said. Brightmark plans to continue operating that facility throughout the court process and said the process is “not intended to have any impact” on the 90 employees who work there, according to a news release.

- Brightmark said it will still continue plans to build another facility in Thomaston, Georgia, which it announced in 2024. The company is in the process of filing for an air permit for that $950 million project.

Dive Insight:

Brightmark’s challenges in Ashley mirror recent news from some other chemical recyclers facing operational and financial stumbling blocks as they work to ramp up capacity.

Questions about the viability of the Ashley pyrolysis facility’s operations have been a challenge for Brightmark for several years. In 2022, the company scrapped plans with the Macon-Bibb Industrial Authority to build a $680 million facility in Georgia, due in part to the authority’s questions over whether the Ashley facility would operate as planned, Georgia Public Broadcasting reported.

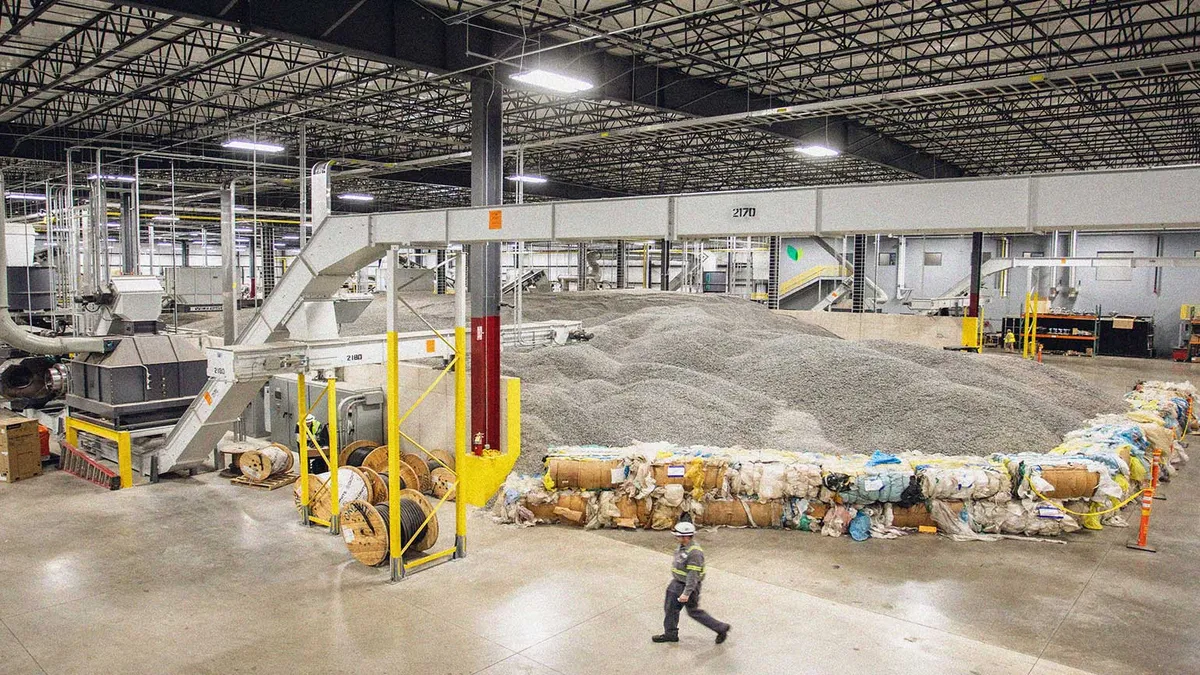

The Ashley facility uses pyrolysis to process “hard-to-recycle” and mixed plastics into fuel. The subsidiaries involved in its operations, Brightmark Plastics Renewal, Brightmark Plastics Renewal Indiana and Brightmark Plastics Renewal Services, say the facility is currently only operating at 5% capacity and can’t generate enough revenue to fund operations, according to court filings.

Brightmark originally closed on a financing package to fund the Ashley facility in 2019, including $185 million in state bonds issued by the Indiana Finance Authority. Over the next few years, the three subsidiaries also received a total of about $211 million in equity contributions from Brightmark, their parent company. On March 1, the subsidiaries missed a scheduled payment and trustee UMB Bank issued a default notice a week later.

The subsidiaries seek to continue the facility’s operations while also pursuing a sale process, according to court documents. The company plans to contact 287 parties about the potential sale, including “strategic buyers, private equity funds, and other financial institutions.”

The subsidiaries told a judge that they also need access to funding in order to continue with capital projects meant to bring the facility up to its full capacity while also increasing the value of the finished product. These capital projects are an important way to "preserve and enhance” the going concern value of the company, the operators said in court documents.

Brightmark said the facility has since “received commitments for sufficient liquidity” to continue day-to-day operations. In a statement, CEO Bob Powell added that the bankruptcy process is a “strategic move designed to ensure the long-term viability of the Ashley facility and enables us to grow our business sustainably. We are excited about the future of our plastics business, and our commitment to it and the Ashley community is unwavering.”

Brightmark is among the chemical recycling companies that have seen both major investments and controversies in recent years.

Chemical recycling is a broad range of processing technologies that break down recovered plastics to the molecular level to become “building blocks” for new plastics or other products. Proponents say such technologies provide recycling opportunities for more kinds of materials and provide possible business opportunities for MRFs and other recyclers. But critics say such projects create pollution and aren’t transparent about how much plastic is processed or sent to disposal.